Table of Content

- Now a lender can determine how much income you could put towards a mortgage

- Repayments

- Thank you, We have received your details, We will call you within 1 business day to discuss your home loan needs.

- Get our money-saving tips and top offers direct to your inbox with the Mirror Money newsletter

- How much of my mortgage repayment is interest?

- Save time, apply online

In the U.S., the federal government heavily subsidises the housing market through GSEs, Fannie Mae and Freddie Mac. U.S. homebuyers have the ability to lock in a fixed rate for up to 30 years. The U.S. government backs Fannie Mae and Freddie Mac purchases of mortgage securities. With strong government-backing, over 90% of U.S. borrowers opt for fixed-rate loans. In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans.

Get $4,000 cashback when borrowing 80% or less of the property valuedisclaimeror get $2,000 cashback when borrowing more than 80% of the property value. We'll ensure you're the very first to know the moment rates change. This will help you pay off the home loan more faster or might even be equivalent to making a part-payment on the home loan. "Don't make any assumptions that interest rates could go down to the cheaper rates we used to have, as 4.5 to 4.75% could be the new normality." But Martin warned not to make any assumptions that interest rates could go down further. “When we had the calamitous mini budget, the prediction was that interest rates would be peaking at around 6% next year.

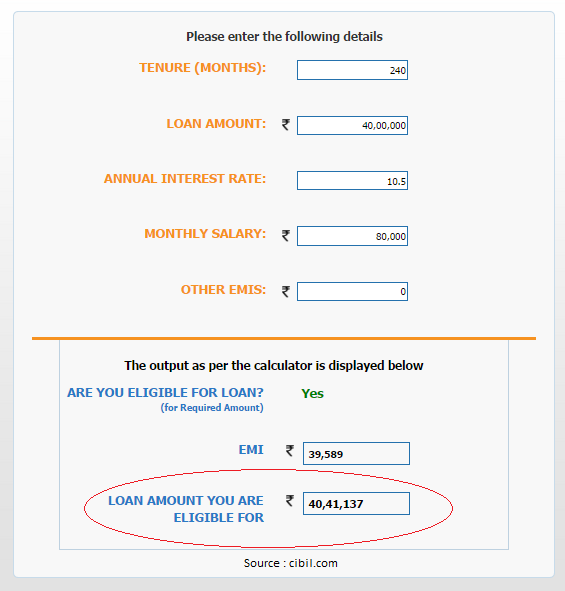

Now a lender can determine how much income you could put towards a mortgage

But you run the second calculation using the fee as part of the loan amount. The following graph illustrates the changing mortgage approval levels in 2020. Before lockdown was lifted in May 2020, UK mortgage approvals reached as low as 9.3 thousand. However, approvals surged to 40.3 thousand in June 2020 as businesses began reopening.

In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. Down payment—the upfront payment of the purchase, usually a percentage of the total price. This is the portion of the purchase price covered by the borrower.

Repayments

Debt-to-income calculatorYour debt-to-income ratio helps determine if you would qualify for a mortgage. This is an estimate for illustrative purposes only and is based on the limited information provided. Read these articles below for some insights on repaying your current mortgage. “The problem for me, is they’re often not reversible, and people often don’t do them because they’re not reversible and they impact their credit file."

The calculator assumes that the interest rate will remain the same throughout the mortgage term. Rounding of repayment amounts- The calculator uses the unrounded repayment to derive the amount of interest payable over the full term of the loan. This is why a lender needs to assess the amount you’ve asked to borrow to determine if that’s an affordable amount for you.

Thank you, We have received your details, We will call you within 1 business day to discuss your home loan needs.

Using that to pay off a high-interest home loan may help you save more money. Calculate mortgage expenses such as home loan applications, monthly repayments, property management and more. “The current prediction is that interest rates will be peaking at 4.5 to 4.75%. This means if you have a fixed rate now, compared to two months ago, it’s cheaper."

Estimated repayments are calculated on a monthly basis by default, but you can adjust the frequency to weekly or fortnightly if you’d like to compare the difference. Over the life of your loan, your interest rate will fluctuate in line with changes made to the official cash rate, or at the discretion of the lender. Any fluctuation in the interest rate impacts your mortgage repayments. If your interest rate is increased, you’ll be paying more interest on your loan while if your rate is cut, you’ll pay less.

1.27% of total loans were in arrears at the end of the fourth quarter of 2020. Central banks have been having interest rates pegged at the lower bound, and some even employ negative interest rates. As fiscal intervention picks up, rates are likely to head higher eventually. In fact, early on in the COVID-19 crisis, the Federal Bank of New York’s Kenneth D. Garbade authored a report on yield curve control measure that were used during and after World War II.

Be sure to evaluate the pros and cons before making the refinancing decision. The rate shown is the Simplicity PLUS Home Loan index less the applicable special offer discount. Eligibility criteria apply to special offer discounts, including $50,000 or more in new or additional ANZ lending. In the early years of a principle and interest loan, most of your minimum repayments go towards paying interest on your principal loan amount. Any repayments above your minimum go directly towards the principal – so as this amount reduces, so does the interest charged on it. In turn as the interest payments get smaller, the portion of your repayments going onto the principal increases.

Loans are to be fully drawn and have more than the scheduled repayments as available funds. General advice on this website has been prepared without taking into account your objectives, financial situation or needs. Consider the relevant disclosure documents, which include Greater Bank's Banking Terms and Conditions for some products, Product Disclosure Statements for others and Greater Bank's Financial Services Guide . The Banking Terms and Conditions or a PDS are relevant when deciding whether to acquire or hold a product. By accessing and viewing this site you agree to be bound by the Terms & Conditions of this website. After a bank that offers great value products and convenient services, while making you feel like a person instead of a number?

If you’re thinking about buying a home, one of the first things you’ll want to work out is your budget. And if you’re buying with a mortgage, you’ll also want to work out how much you’ll feel comfortable repaying on a loan each month. Westpac's home loan lending criteria, terms and conditions apply. “However, the cost to secure a new fixed deal is much higher than they may realise, as both the average two- and five-year fixed rates have increased by over 3% during the past year.

However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save. Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit.

No comments:

Post a Comment